10

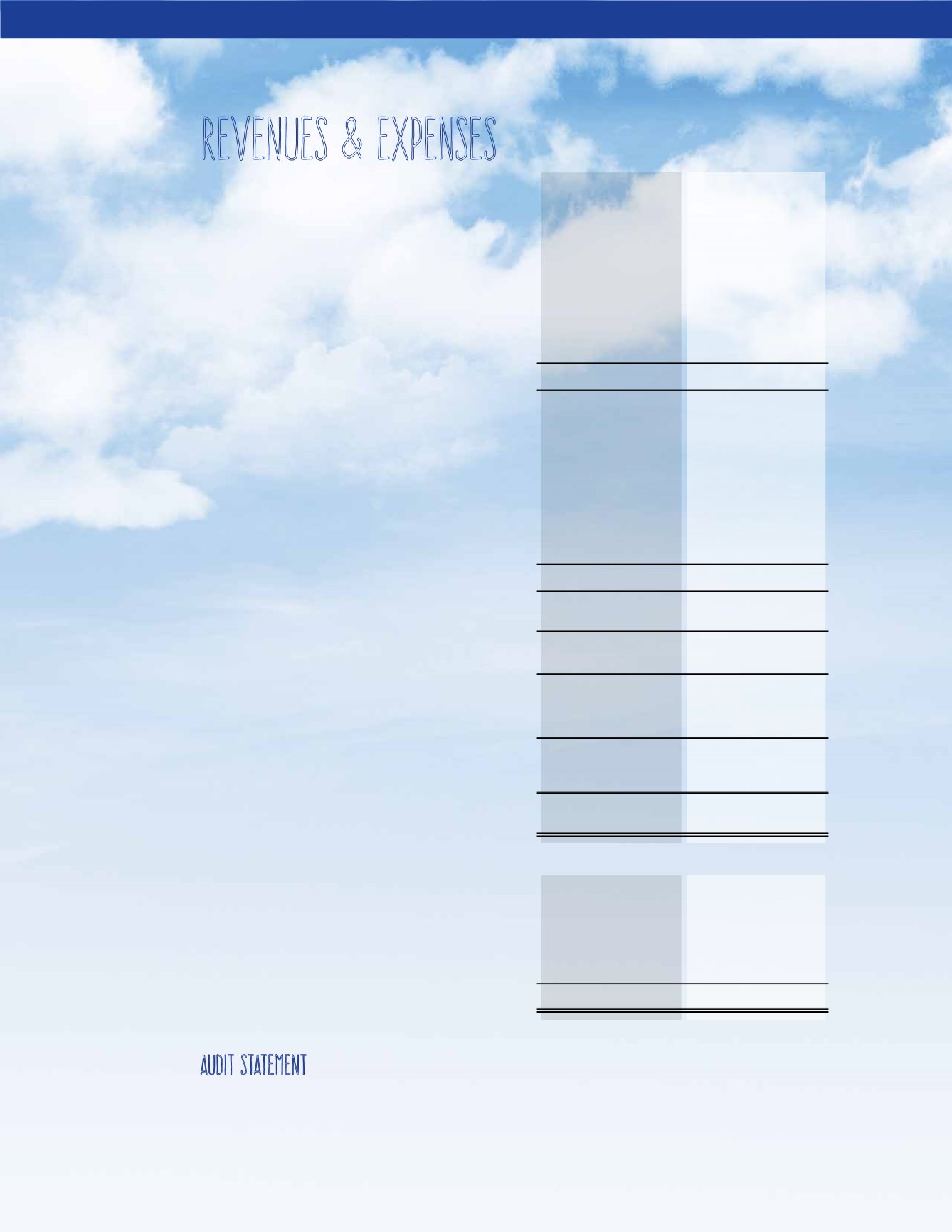

OPERATING REVENUES:

2015

2014

Local Customer Services

$ 5,903,869

$ 5,288,086

Intercarrier Services

7,209,520

6,736,531

Universal Service and High Cost Support

9,049,032

8,042,263

Television Revenue

3,618,546

3,133,214

Internet Revenue

2,938,775

2,875,666

Miscellaneous Revenue

3,497,638

3,687,873

TOTAL OPERATING REVENUES

32,217,380

29,763,633

OPERATING EXPENSES:

Plant

10,126,610

10,343,090

Depreciation

8,058,119

6,101,707

Customer and Corporate

4,475,402

4,490,086

Other Operating Taxes

95,923

94,227

Non-regulated Expenses

5,820,840

5,449,919

TOTAL OPERATING EXPENSES

28,576,894

26,479,029

OPERATING MARGIN

3,640,486

3,284,604

NET NON-OPERATING INCOME

1,678,575

2,265,614

NETMARGINBEFORE INTEREST

AND INCOME TAXES

5,319,061

5,550,218

Interest on Long-Term Debt

2,273,355

1,975,999

Income Taxes

73,209

9,108

NET MARGINS

$ 2,972,497

$ 3,565,111

STATEMENT OF PATRONAGE CAPITAL:

Patronage Capital - Beginning of Year

$ 29,090,139

$ 25,765,370

Net Margins for Period

2,972,497

3,565,111

Federal Excise Tax Refund to Patrons

28,054

26,095

Retirement of Capital Credits

(448,111)

(266,437)

Patronage Capital - End of Year

$ 31,642,579

$ 29,090,139

Revenues & Expenses

AUDIT STATEMENT

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the consolidated

financial position of Reservation Telephone Cooperative and subsidiary as of December 31, 2015 and 2014, and the results of

their operations and their cash flows for the years then ended in accordance with accounting principles generally accepted

in the United States of America. —Moss Adams, LLP